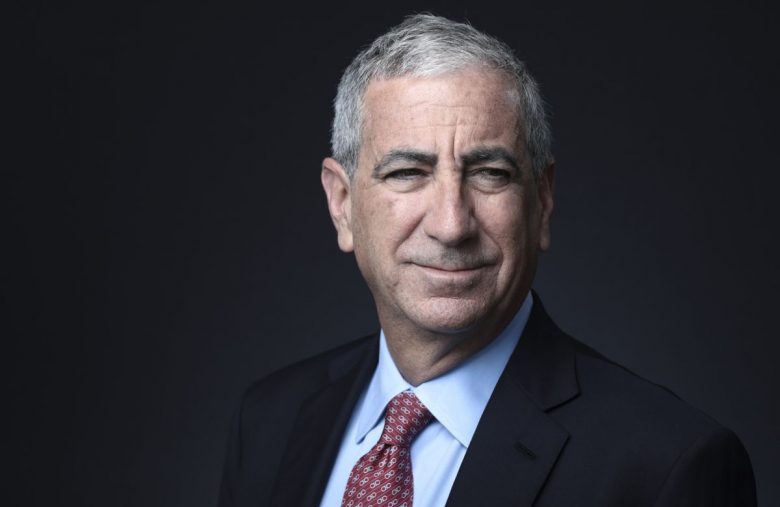

American Billionaire Ken Moelis Compares the Crypto Craze to the Gold Rush of 1848

The founder of the investment bank Moelis & Company – Ken Moelis – asserted that his institution is fond of the crypto market. He opined that people nowadays are just as crazy about digital assets as they were about gold back in 1848.

Crypto Might Come to Moelis & Company

In a recent Bloomberg interview, Ken Moelis shared his thoughts on the future of cryptocurrencies alongside his personal opinion about them. Despite saying that it is not likely to invest his personal funds in crypto assets, he noted that his company is quite interested in them:

”Definitely on the business side, we are focused on having expertise.”

Billionaire Ken Moelis, founder of investment bank Moelis, says he’s watching the cryptocurrency space carefully but cautiously for new business opportunities.

— Bloqport (@Bloqport) June 8, 2021

“It’s like the gold rush of 1848,”pic.twitter.com/QpOGiNSid9

The American billionaire added that the mission of Moelis & Company is to provide its customers with the tools they need, so if there is a high demand for crypto, they would definitely add the service:

”We have to know what people want, what tools they need to be successful.”

Moelis also compared digital assets and gold. He found similarities between the ongoing crypto craze and the gold rush back in 1848 when many investors generated significant profits from it:

”It’s like the gold rush of 1848 when a lot of people didn’t know there is gold in the ground.”

In addition, the billionaire stated that he tries to stay on track with the cryptocurrencies, although he is not a total believer of their merit.

Crypto vs. Gold

The relation between virtual assets and the precious metal has been a hot topic, and many experts in the crypto community shared their thoughts on it.

In early May, the billionaire investor and owner of the NBA team Dallas Mavericks – Mark Cuban – opined that Bitcoin and gold are both financial religions. However, he praised BTC as the better asset as it’s easy to store, trade, and create. It is worth noting that in the past, he did not share such a positive opinion. A few years ago, he even stated that he would prefer bananas over the primary cryptocurrency.

The Global Head of Commodities Research at Goldman Sachs – Jeff Currie – surmised rather differently. He said that cryptocurrencies are very volatile and insecure, and comparing them to gold is wrong as they are more suitable to be copper replacements:

”Digital currencies are not substitutes for gold. If anything they would be a substitute for copper. They are pro-risk, risk-on assets.”