Cardano (ADA) Price In Trouble: Network Activity Tanks While Sell Signals Pop Up

- Cardano price was still in critical zone.

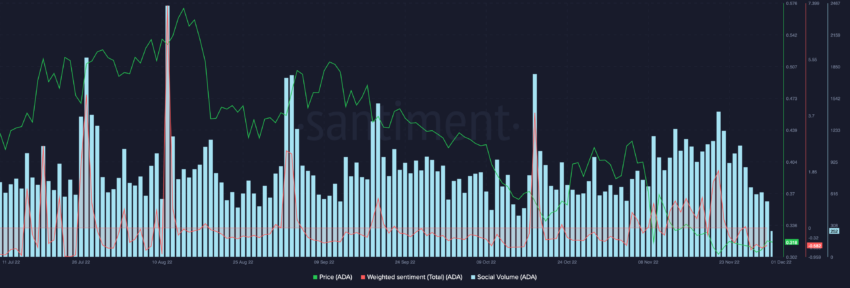

- Social metrics for Cardano looked barren, with social volumes making a downward slope.

- ADA price DAA divergence made red bars presenting a sell-signal, as seen in July 2022.

Cardano (ADA) price remained largely unchanged, or bearish, oscillating close to the multi-month low price support.

The global crypto market is still on its knees, with most cryptocurrencies trading close to their long-term support zones. A few altcoins, however, have managed to make some strides in the upwards direction. On the other hand, some coins, like Cardano, are still in critical price zones.

FUD Hindering ADA Price Action

A recent Tweet by crypto Trader DevCharts highlighted that ADA and FLOW were two cryptos closest to major support levels. He further noticed that these large caps altcoins haven’t really moved away from these long-term supports.

For ADA, the analyst said that there was some FUD (fear, uncertainty, doubt) in the market around Ardana (a DeFi project) stopping development. This FUDs has further hindered the ADA price recovery.

Social metrics for Cardano looked barren, with social volumes making a downward slope. The weighted social sentiment was still negative and oscillated close to the four-month low. Negative weighted sentiment showed low social anticipation around the coin, thus less demand.

At press time, ADA price traded close to the $0.318 mark, up just 1.06% on the daily. However, there seemed to be no major push by bulls that could kick ADA price to $0.35.

Sell Signals Loom Over Cardano Holders

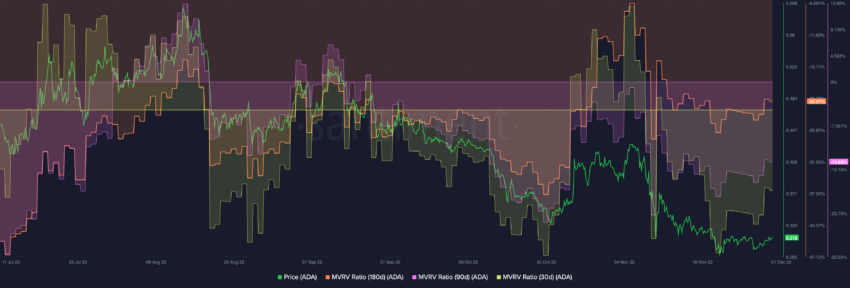

With ADA price still near the long-term support, price action needed a strong push from bulls and holders to move upward. However, long-term and short-term MVRVs were negative showing HODlers in losses.

The 30-day, 90-day, and 180-day MVRVs were negative, showing that these holders were underwater.

In addition to that, price Daily Active Addresses (DAA) divergence made red bars present a sell-signal, as seen in July 2022.

In the short-term on-chain metrics for ADA present a slow price growth. If bulls are able to push the price above the $0.36 mark and then $0.40, the same would confirm some sort of reversal. However, if the ADA price falls further, Cardano could revisit the lower $0.30 mark.