Even after more than a decade of continuously banning cryptocurrencies, China has still not learned that bitcoin always triumphs.

Right from the very first year bitcoin came into existence, the Chinese government has gone after the primary cryptocurrency, hammering it with bans after bans while citing countless risks supposedly associated with it.

In over a decade, the Republic of China has also managed to increase its FUD (short for fear, uncertainty, and doubt) in the industry, and each time, crypto had seen a massive hit. Just last week, bitcoin’s price fell by more than 5% within hours, owing to another regulatory reiteration from the Chinese authorities to ban cryptocurrencies.

Before we dive into the long history of China FUD, there is good and bad news to this story. The bad news is that this kind of Chinese FUD is likely to continue, at least over the next years. However, the good news is that the effect on the price of Bitcoin seems to be decreasing over time, as BTC is becoming more and more resistant.

China FUD Vs. Bitcoin

With the endless bans and unnecessary repetitive threats, one might think it’s a well-coordinated effort to bring bitcoin’s price down. But that is perhaps a story for another day.

For now, let’s walk down memory lane and see all the times China has raised FUD levels in the crypto market through its endless hostile stance and vows to end crypto activities and how the industry continues to triumph.

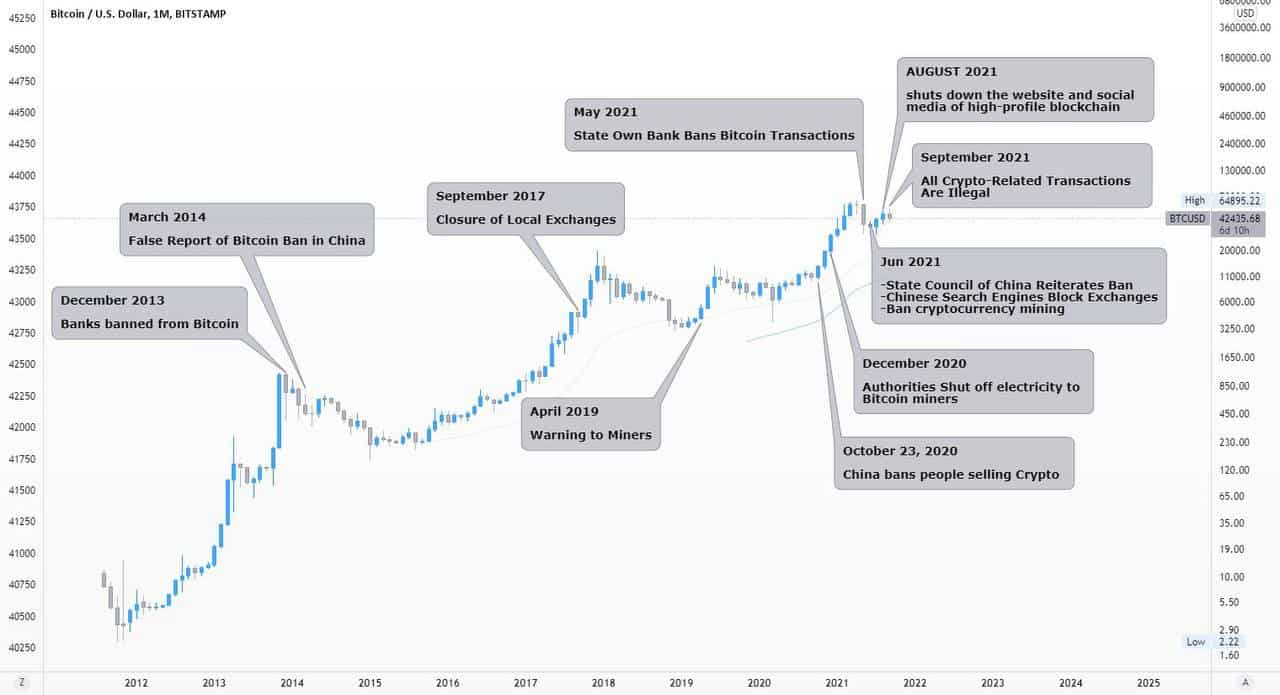

China’s Bans on Bitcoin. Source: TradingView

2009 – Ban on Digital Currencies

In June 2009, just a few months after bitcoin was launched, China’s Ministry of Commerce and Ministry of Culture banned the use of digital currencies in making payments for real-world goods and services.

The move, however, was not explicitly targeted at bitcoin, instead, it was to curtail several video-game currencies that were supposedly devaluing the yuan.

2013 – China Pops Following Bitcoin’s First Major Bull-run

Four years later, in December 2013, the world’s most populated nation made its first direct attack on the use of bitcoin, calling it ‘a currency without real value.’

The People’s Bank of China (PBoC) and the IT Ministry published a note mandating every Chinese financial institution to stop processing bitcoin transactions.

The effect of that notice was immediate, forcing bitcoin’s price, which had just crossed the $1k mark, to plummet massively – the first price impact out of many to follow.

The People’s Bank of China. Archive

2014 – The Bear Market Driven by China FUD

After bouncing back from the 2013 China FUD, the crypto industry was once again struck with another devastating report that the “PBoC has placed an outright ban on Bitcoin transactions.”

While that news, which was published in March 2014 by Weibo, turned out to be false, its effect on the market was catastrophic. Thousands of traders and investors liquidated their positions, and bitcoin’s price took a nosedive. BTC, which was trading above the $1k mark by end of 2013, was heading towards $400 just three months after.

2017 – Exchanges Forced to Leave China

2017 will always remain a memorable year in the history of crypto. It was the first time that bitcoin hit $20,000 in December, yet, it was ridden with more FUD from the Chinese government than in previous years.

In mid-2017, the PBoC dropped two regulatory bombs in the same month. The first ban was on Initial Coin Offerings (ICOs), which were trending at the time. The second was targeted at cryptocurrency exchanges.

The authorities insisted that every ICO actively going on in the country should immediately be discontinued, citing that they were illegal forms of public financing and were not authorized by China’s financial regulators.

By mid-September, the PBoC hit the crypto market with the notice of yet another ban. Every cryptocurrency exchange operating in the country was mandated to discontinue its services by end of September 2017, citing risks of their use in facilitating criminal activities like drug trafficking, money laundering, and smuggling.

Several top crypto exchanges, including Binance – which was operating from China back then, had no other option but to relocate and crypto traders across the country had to move their trading activities to overseas platforms via VPNs.

The prices of the leading cryptocurrencies suffered. But as always, the market recovered within three months, and it even turned out to be a breaking point for crypto worldwide as BTC hit its then all-time high (ATH) of $20,000 in December 2017.

Binance. Left China in 2017, found a new home in Malta

2018 – Targeting Mining

In early 2018, Bitcoin suffered one of its biggest price crashes in history. Shortly after ending 2017 with highs of $20,000, the value of the primary digital asset fell by more than 65% against the USD around February of that year.

While there was no solid reason for the decline, several reports suggested that the plunge was closely tied to the Chinese New Year and rumors of a new crackdown on crypto mining.

In August 2018, China reportedly issued another document officially banning all crypto activities in the region. The paper focused on communication channels as it prohibited commercial venues like WeChat accounts, media outlets, and others from hosting any crypto-related events or activities.

2019 – Bitcoin Mining Ban Confirmed

Rumors of a massive crackdown on bitcoin mining were confirmed in April 2019, when a draft warning from the country’s National Development and Reform Commission (NDRC) noted that the regulator was planning to eliminate these activities in China.

The draft argued that bitcoin mining did not adhere to relevant laws and regulations set in place and polluted the environment. BTC’s price, once again, dropped significantly.

2020 – Power Stations Ordered to Halt Power to Miners

With the outset of the COVID-19 Pandemic, several Chinese miners liquidated their crypto holdings, resulting in the massive bloodbath in March, which saw bitcoin and almost all altcoins losing more than 50% of their value.

Despite the global pandemic, in May 2020, local government authorities in the Chinese province of Sichuan were seeking to ban cryptocurrency mining operations in the region.

In October, the market was struck again by a ban on crypto trading. Offenders were threatened with fines that were five times the value of their crypto funds.

In December, power stations in the Yunnan province, where many of the largest crypto mining hubs in China were located, received mandates from the local authorities to stop providing power to miners in the city. This resulted in a sharp drop in bitcoin’s hash rate.

However, bitcoin was able to break the $20,000 mark and end 2020 with a new ATH of over $30,000. The hashrate also recovered somewhat rapidly.

2021 – Miners Leave China: Crypto is ‘Illegal’

2021 started off for bitcoin and the crypto market at large. After ending the previous year with a high of 30,000, BTC continued to chart new records until it peaked at around $65,000 in mid-April.

However, things quickly became dark for crypto traders as the Chinese government embarked on a nationwide campaign against crypto mining and trading. It reiterated its warnings for the 20th time to citizens about the risks associated with investing in such “speculative” assets.

Even though every financial service provider and payment gateway in the country has already been prohibited from working with crypto entities since 2013, the news resurfaced in May 2021 and sent the crypto market crashing down the hill. Bitcoin lost nearly half its value in weeks.

Within the last four months, China has intensified its fight against crypto activities like never before. In June, officials reiterated the bitcoin mining ban (again) and went on a massive crackdown on bitcoin mining facilities, forcing miners to shut down their machines.

The clampdown on such operations not only affected several key on-chain metrics and caused prices to drop but also prompted the still-ongoing Great China Mining Migration, as miners in the region started moving to other crypto-friendly locations.

In July, another report emerged that the PBoC shut down a tech firm allegedly providing software services to local cryptocurrency entities. Bitcoin’s price immediately fell as soon as the news broke.

In August, China went after crypto influencers, and the government shut down the website and social media handles of the country’s high-profile blockchain center.

On September 24, the market took another hit as the PBoC supposedly declared that all crypto-related transactions in the country are illegal. Even though the news was from September 3, it did not stop bitcoin’s price from shredding $4,000 within hours, causing massive liquidations.

Verdict: Bitcoin Always Triumphs

For the past years, the Chinese authorities have often tried to bully bitcoin and force it out of existence, but all its efforts – so far – have always proved a failure. The crypto industry continues to thrive as the market usually recovers from whatever blows it receives from the giant Asian nation.

Bitcoin has retained its position as the largest cryptocurrency, with an influx of large institutional investors fueling its adoption rates.

Judging by the patterns of the previous cases caused by the Chinese government, bitcoin often goes on a massive bull run within a few months after suffering the effects of the same old regulatory song from China.

Will China’s latest attack spur bitcoin to another ATH? Only time will tell.