Crypto crash caused by Celsius Network: what it all means, a Deep Dive

- Celsius have suspended withdrawals, but what does this mean for their solvency and the market as a whole?

- On-chain data shows Celsius had invested in Anchor Protocol, the Terra platform which went to zero last month

- Tether and Canada’s second largest pension fund are among Celsius investors – will the contagion spread?

Oh, dear. It feels like only yesterday I was writing a deep dive on the Luna/UST death spiral which sent the cryptocurrency markets into meltdown – Bitcoin tumbling from $40,000 to $30,000 and an entire ecosystem vanishing.

I woke up this morning to see Bitcoin trading at $23,500, as the lending platform Celsius announced it was suspending all withdrawals and transfers. Mondays are tough enough already – come on. But I guess another death spiral deep dive is in order.

What does this mean?

Before getting our hands dirty, let me quickly explain what Celsius is in simple terms, for those unaware. It functions similarly to a bank – but a very aggressive bank (I grew up in Ireland and lived through our banking crisis of 2008, so I’m unfortunately have seen echoes of this before!).

Customers deposit their crypto into Celsius (Bitcoin, Ethereum, whatever), and the platform lends out this crypto to borrowers. Therefore, the customer is handing over their crypto to Celsius, who in turn lend it out, like a bank. Celsius pays depositors a yield, which is the motive for customers to deposit their crypto with Celsius. This yield is dynamic and varies from time-to-time. I pulled the latest rates on Bitcoin, for example, off the Celsius website and pasted below. Bitcoin is just an example – there is the option for depositors to earn a yield on all sorts of various cryptocurrencies and stablecoins.

As can be seen from the above, this yield can be boosted if depositors elect to receive their rewards in the native token of the platform, Celsius (rather than the currency in which they deposit).

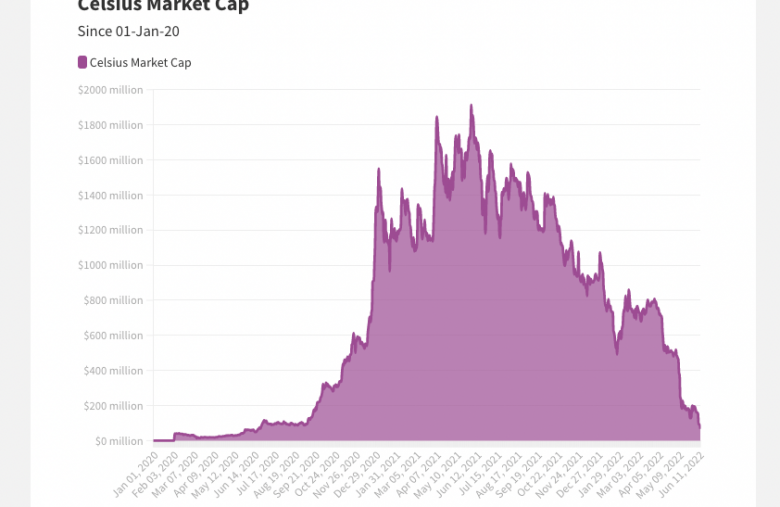

Anyone who chose to chase this additional yield and receive Celsius tokens has likely regretted it, I think it’s fair to say. As I write this, its market cap is $66 million, down 97% from an all-time high of $1.7 billion, nearly a year to the day. If it wasn’t so devastating, the price graph would be almost poetically symmetrical, wouldn’t it?

Celsius pauses withdrawals

Just like how I mentioned above, the banks went under in my native Ireland back in 2008. Eventually, they had to be bailed out by the IMF in a $67.5 billion rescue package (for context, we are a small country – that amounted to over 40% of our GDP and is one of the greatest banking crises in history). It’s the same situation here, there are now fears that Celsius is insolvent after last night’s announcement.

So, let’s see what this means.

Firstly, the qualitative side is simple and rather damning. A business such as Celsius relies on liquidity to function. If customers no longer feel comfortable depositing, there is no business – again, just like a bank. So, an announcement like last night’s, that customers have lost access to their funds, is obviously the worst possible thing that could happen as it destroys confidence going forward. For this simple reason, two things are immediately extremely clear and don’t need to be overcomplicated:

- Celsius is in massive, massive trouble, and their decision to suspend withdrawals was forced upon them, and amounts to a last-ditch effort to save the business

- Confidence in the long-term model is now gone, and that itself is a killer blow

The first point I will elaborate on next, and assess quite how much trouble they are in, as well as how they got to this spot. The second is exactly what we saw with the Terra death spiral – the crisis is a crisis itself, without sounding like a far-too-confusing Christopher Nolan script here.

A business model which relies on customers’ trust in a centralised agency is not going to fare well once that very same centralised agency burns those customers. As sad as it is, you know what has to happen once a dog bites the milkman, right?

Funnily enough, Celsius are a good source of advice here on how important it is to retain access to your funds:

Did someone say irony?

What actually happened here?

“Due to extreme market conditions, today we are announcing that Celsius is pausing all withdrawals, swap, and transfers between accounts,” Celsius Network said in their statement. “We are taking this action today to put Celsius in a better position to honor, over time, its withdrawal obligations.”

I wrote about the potential for something like this happening in the aforementioned Luna death spiral article, and it shouldn’t come as a surprise to the market. Luna was a $42 billion coin at its peak, while UST was a stablecoin worth $18 billion – and there was $17 billion in the Anchor protocol. This is a colossal amount of capital, and it cannot simply vanish without contagion effects. Celsius appears to be one of those contagion victims. I don’t believe they will be the last.

The first curious red flag for Celsius specifically came when the below rumours started circulating last month, alleging that Celsius was involved in discussions of a Terra buyout when that crisis was going down last month. Why, should we ask, did Celsius care? Could it be that they are somehow involved in Terra? If only there was a platform where a company could earn easy yield…

This was a red flag in itself, but there were also rumours on Twitter of potential doomsday effects. Conspiracies circulate every day in crypto, and most are not worthy of paying attention to, but the bottom line here is clear: this is a contagion fallout from the Terra crisis, and any yield-paying product’s risk spiked massively in the wake of the Terra crisis. As I said in the previous article, who knows which companies invested in Anchor behind the scenes? Who knows what they were doing with investor or customer funds while waiting to deploy them?

Numbers

It is now clear that the rumours, of course, were more than just rumours. And this is where it gets interesting, as we have the blockchain on our side broadcasting everything in real-time. After closing its Series B raise last November, Celsius was valued at $3.5 billion, while the CEO stated they had $28.6 billion in assets under management (AUM).

This report five weeks ago from The Logic then showed that AUM had fallen to $12 billion. They were also shown to be involved in the UST crisis. Digging into the blockchain, this wallet is an ugly read (seriously, if you thought your portfolio was looking bad, take a look into that one), show to be withdrawing funds from the Anchor protocol during the UST fiasco. Oh yeah – and the wallet belongs to Celsius. Woops.

If I was to see my lending platform withdrawing $225 million from Anchor, in addition to the above report highlighting the AUM drop, as well as the continued bearish macro sentiment and fallout from the UST crisis, I would be very fearful for my capital, to say the least. And that’s a pretty obvious conclusion to reach, which meant a lot of people thought it. And suddenly, we have a capital run that the platform can’t sustain.

Blockchain analytics firm Nansen also asserted that Celsius may also have “significant ETH liabilities”. They weren’t wrong. Take a look at this address, as Celsius transferred over $320 million of crypto to the FTX exchange before announcing the withdrawals were suspended in a desperate bid to shore up liquidity.

What does it mean going forward?

I believe it’s the end of Celsius. I simply can’t imagine how they restore confidence in the business model from here, even if they do survive insolvency in the short term. They are now in the same spot that Do Kwon and his Terra cronies were, desperately flailing around with their Bitcoin sell orders to shore up the peg.

I guess they could merge with the now-renamed Luna Classic, and create some sort of new airdrop – maybe they could call it Fahrenheit? Oooh, I like that name. Sell a few NFTs and that could be a $1 billion market cap coin right there.

But seriously, the timing couldn’t be worse here – investors are still burned by the UST fiasco, the stock market is nuking and recession fears are growing (if we are not in one already). Wallets are thinning with the inflation crisis, and everywhere you turn there is bad news. Now you want me to trust you again with my money after you burned me before? No thanks.

But that’s the best-case scenario – where Celsius survive long enough to even attempt to rebuild the business. I can’t see that happening.

Contagion

As I have said multiple times, this is a side-effect of contagion, and the contagion may not be over. It’s sad, because akin to the Terra fiasco, retail investors are left holding the bag because of them bearing risks that they didn’t know they were taking in the first place. Many didn’t know the mechanism behind the UST stablecoin, just like many didn’t know that Celsius were yield-hunting via the Anchor protocol.

These contagion effects may not be over, either. If I were you, I would sit this out until it blows over – the yield you are recouping does not compensate you enough for left-tail risk, which is significantly more likely amid this risk-off environment.

Just to illustrate the potential knock-on effects here, Canada’s second-largest pension fund (CDPQ), with $420 billion AUM according to their website, invested $400 million in a Celsius funding round in October. Their Executive Vice President told the Financial Times at the time that the fund was focused on making “opportunistic” investments in “diamond in the rough” early-stage companies leveraging blockchain technology, as part of its $40bn exposure to financial services worldwide.

“This is a small diversification play. We are not going to go all out on digital assets,” he said, adding that CDPQ would not consider allocating funds directly into digital assets. “Bitcoin? No, absolutely not,” he said. Woops.

Tether

Everybody’s favourite stablecoin, Tether, are also involved – which is of course enormous news for the health and liquidity of the entire crypto ecosystem. Tether lent $1 billion to Celsius in 2021, charging an interest rate between 5% and 6% according the Celsius CEO Alex Mashinsky. While Tether claim that all loan activity is “overcollaterised”, they are also an early investor in Celsius (they were even the lead investor in the June 2020 funding round), and were forced to issue a statement declining their involvement.

While Tether’s investment portfolio does include an investment in the company, representing a minimal part of our shareholders equity, there is no correlation between this investment and our own reserves or stability.

Market impact

Markets are freefalling. In the light of the above, and the fact that Tether had de-pegged during the UST crisis to 95 cents, I would not have expected it to hold so firm here. While technically it has dipped, it is currently trading at only $0.9975 – still unacceptable for a stablecoin, mind you, but holding relatively firm. Don’t be surprised if this changes in the near future.

On the other hand, Bitcoin has boarded a one-way train to Paintown. The below one-day chart illustrates this well, creating a lovely 45-degree angle as it has nosedived from $28,000 to $23,500 at time of writing.

Sure, it is a crisis and there is going to be a dip, but does the punishment fit the crime here? A 16% plunge is a lot, and I don’t believe Celsius is totally responsible. Had we not got the inflation numbers on Friday and the accompanying nuke of equity markets, the consequences aren’t this drastic. Mainstream media will likely focus on another crypto death spiral, but the weather outside is frightful – and it’s not all because of Celsius.

However, Celsius does hold Bitcoin, exactly like Do Kwon held Bitcoin during the UST crisis. That amounts to known selling pressure, which cause Bitcoin holders to sell, which causes more panic, and the cycle goes on. Have you heard this part before?

It is customers’ Bitcoin being liquidated and retail – again – hold the bag. So it’s another sad day for crypto in what is a very torrid run. But if you’re going to take one thing away from all this, friends, it’s that in this case, the Bitcoin maxis have never been so correct:

Not your keys, not your coins.