The Russia-Ukraine War Has Greatly Impacted Crypto, New Report Reveals

As the Russo-Ukraine war rages on, crypto has remained in the forefront of the war on both sides. President Vladimir Putin’s regime has been sanctioned by the West, led by the United States and the European Union, which included denying Russia access to foreign reserves. Soaring energy and commodity prices have harmed the global economy, and capital markets are coping with the uncertainties and long-term implications of Putin’s actions.

However, the crypto community has also been impacted by this war. Crypto donations continue to pour into Ukraine, while crypto principle of being unbiased and decentralized has been challenged by several governments and pundits. To what extent has crypto been put at the war front?

New report from DappRadar says a lot.

DappRadar Shows That Russia Turned To Crypto

The situation in Russia, on the other hand, is significantly more serious and complicated. Aside from PayPal, Visa, and Mastercard, payment and remittance services from Apple (Pay), Google (Pay), Wise, Remitly, and TransferGo have all stopped operating in Russia, adding to the difficulties faced by a Russian working-class that may be facing credit default.

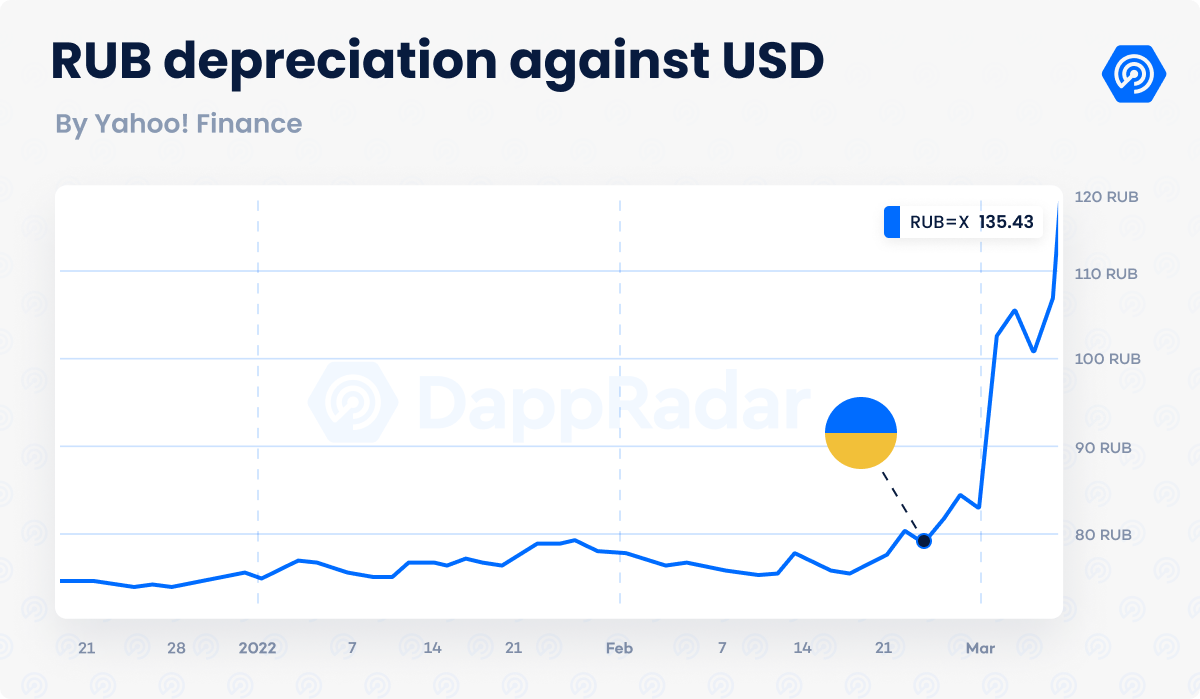

As a result, the most respected rating agencies have dramatically reduced Russian credit rates. Russia’s sovereign ratings were lowered to junk status by S&P and Moody’s, while Ukraine’s credit rating was downgraded by Fitch. In the previous seven days, the Russian ruble has lost about a third of its value, and it could go significantly worse.

Blockchain’s benefits in terms of accessibility, decentralization, security, and storing value extend beyond the economic context of a digital currency. The social potential of a well-organized crypto society is being demonstrated.

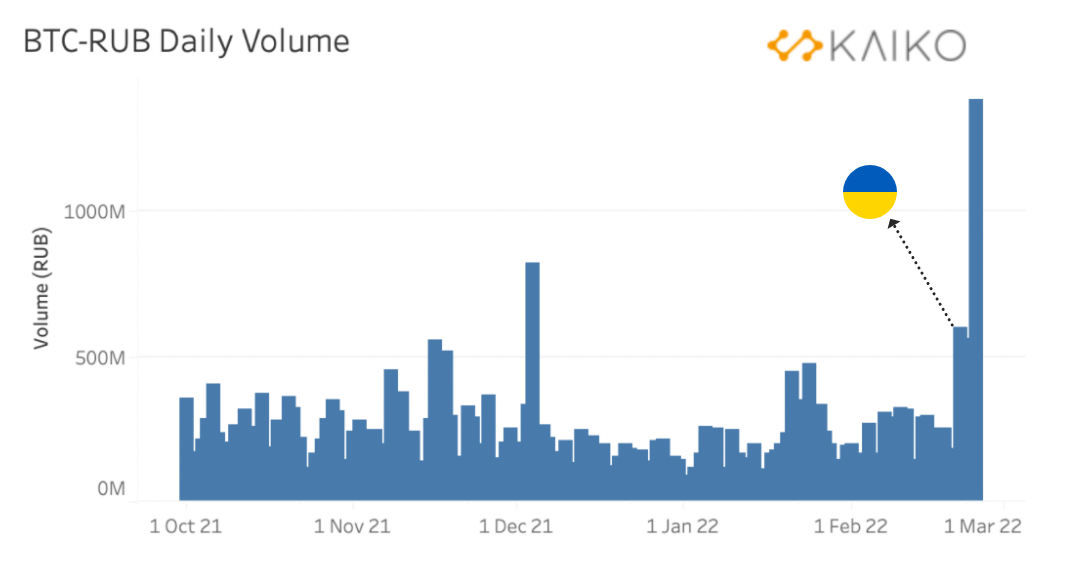

It’s true that cryptocurrencies have been used to get around international sanctions in the past. North Korea amassed enormous amounts of bitcoin through ransomware operations; the regime converted an unknown amount of money into useful currency, most likely in the tens of millions of dollars. For Russia, crypto has also been a way to bypass Western sanctions with many Russians turning to their crypto stash has they are being cut off global financial systems.

Donations And Humanitarian Funds

On several times, blockchain has demonstrated its ability to have a positive impact on society. This time, the world watched as celebrities, businesspeople, and people from all walks of life banded together to form DAOs, or web3 organizations, to support the Ukrainian people and their beleaguered government.

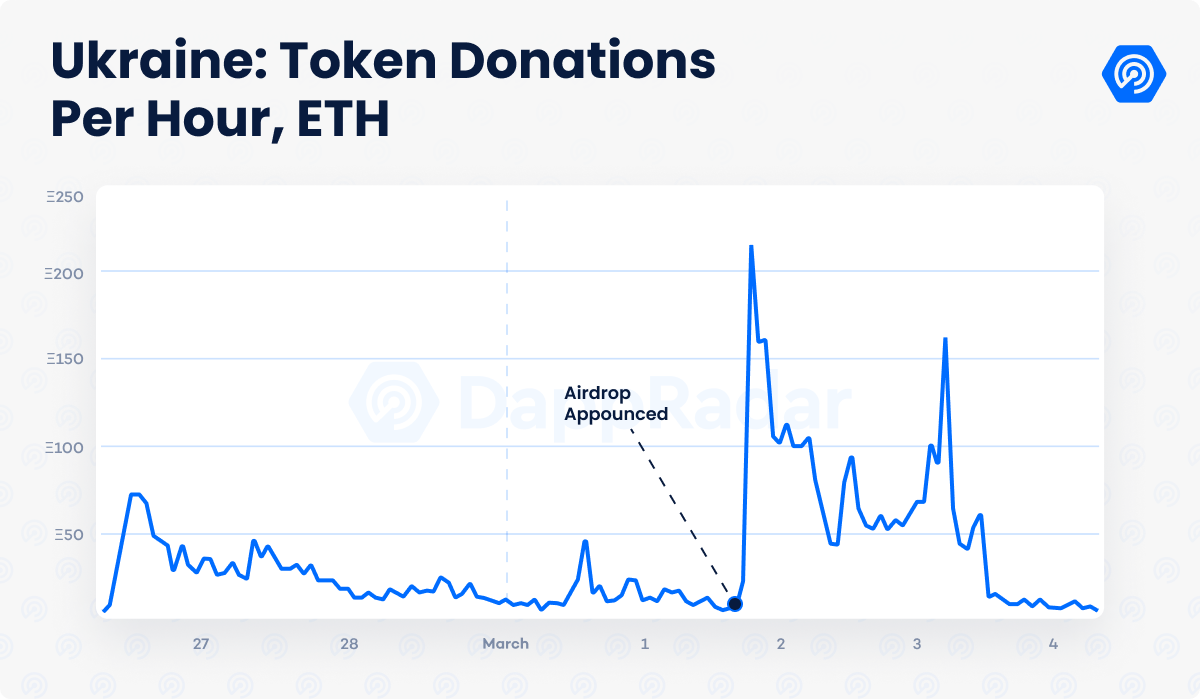

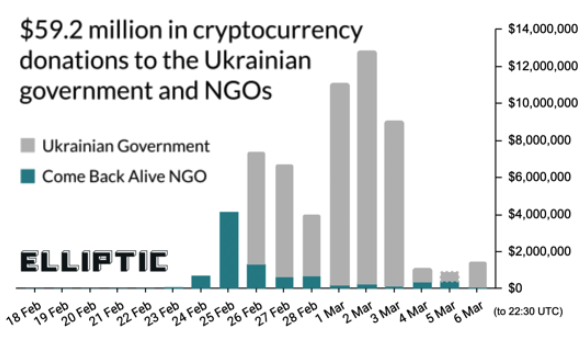

Ukraine began to receive contributions on many networks at a historic period. The Ukrainian government has received about $10 million in tokens and NFTs in its Ethereum wallet (including CryptoPunk #5364 worth approximately $212,000), the majority of which were gathered after proposing a probable airdrop to contributors. Wallets for the Bitcoin, Polkadot, and Tron networks were also made available by the central authority.

Ukraine’s establishment of blockchain wallets is one of the first times a recognized nation’s government has used cryptocurrency, following El Salvador and Venezuela. However, this is the first time the Ukrainian government has utilized them for humanitarian reasons.

Another example is Unchain Ukraine, a DAO founded by Illia Polusokhin, co-founder of the Near blockchain and experienced web3 individuals. Unchain Ukraine has raised over $2.1 million (mostly in NEAR) and is supported by nine networks.

Tracked donations have now supassed $100 milllion following Kraken and BAYC donations.

Rise In Crypto Demand

Since the recent events, demand for cryptocurrencies has increased, particularly in the afflicted regions. Bitcoin purchases in hryvnias and rubles have reached a nine-month high. Since February 24, the quantity of bitcoin bought using rubles has more than tripled, while demand in Ukraine has nearly doubled. In both places, the soaring bitcoin demand resulted in a 6% premium. In Russia, WhiteBit reduced the BTC-UAH trade pair with a 6% premium, but in Ukraine, Binance and Kuna slashed the BTC-UAH trade pair with a 6% premium.

The price of the assets recovered as a result of the rapid spike in demand for cryptocurrencies, defying the negative trend that had been evident since November. Bitcoin has reclaimed its $38,000 support level, while Ethereum has exceeded $2,500.

It is still too early to predict the full extent of this conflict’s consequences and how the rest of the globe will react. For the time being, one goal is important: to bring the conflict to a close as quickly as possible with as few casualties as possible.