What is an Initial DEX Offering (IDO)? How is it Different Than ICO & IEO?

Initial DEX offering or IDO is a new fundraising model that offers better liquidity of crypto assets, faster, open, and fair trading. IDO model is the successor of fundraising models such as ICO, STO, and IEO.

Before we learn about IDO crypto, let’s brush up on our knowledge on the fundraising concept via token sales. If a company wants to raise funds to build new products or expand its business, it has multiple options. The traditional option is to go for financial loans or investments from banks and VCs.

However, since the success of cryptocurrencies – Bitcoin, and Ethereum, more companies had used it as an instrument for raising funds via token sales. Here, the company would create crypto tokens and issue them to the general public in exchange for Bitcoin, Ethereum, other major cryptocurrencies, and fiat currencies. This process is called fundraising via token issuance.

The cryptocurrency community has been particularly creative when it comes to finding new ways to bootstrap projects and raise funds.

In late 2017 and 2018, we saw the appearance of initial coin offerings (ICOs), where teams would raise money by selling a part of their total token supply to the public. This created an absolute euphoria as these freshly minted coins would multiply in value once they were listed on an exchange and open for trading.

Here are the topics I’ll be covering in this article:

What is an Initial DEX Offering or IDO?

IDOs in Their Most Popular Form: How They Differ From IEOs?

Very Low Initial Market Cap: Is This The IDO Secret?

Pros and Cons of IDOs

How to Invest in an IDO?

The Most Popular IDO Launchpad Platforms

ICOs were mainly deployed through Ethereum’s ERC-20 protocol standard, and they quickly became the leading usecase for ETH-based tokens. The first ICOs in 2016 raised just a few million, but a year after that, the average sum was between $20 and $30 million. Soon after that, bigger projects like Bancor raised over $150 million.

The hype was so strong back then that some projects managed to raise whopping sums. The best example for the peak is perhaps EOS – the project received more than $4 billion in funding throughout its long-lasting token sale.

Like everything that becomes too hyped too fast, the ICO bubble burst in 2018, but it didn’t take long for us to see a new model with a few key differences. Towards the end of the first quarter of 2019, initial exchange offerings (IEOs) made their grand entrance.

Largely spearheaded by the Binance Launchpad, these IEOs followed the crowdfunding model of ICOs, but the projects were vetted a lot more carefully. Since they were launched on popular exchanges such as Binance, KuCoin, Huobi, OKEx, and so forth, the exchange teams did extensive due diligence, hence why IEOs weren’t so plentiful as ICOs – there was a higher barrier to entry. Aside from the fundraising, IEOs also benefited from getting listed on the exchange, which managed their token sale. One of the biggest pains of ICOs investors back in 2018 is whether or which exchange will agree to list their token while the variety of ICOs was huge.

Some of the more popular projects that are currently multi-million and even multi-billion dollar enterprises started off as IEOs. These include Elrond, Matic Network (now Polygon), Celer Network, WazirX, and Band Protocol.

In light of the listing concerns, together with the growing popularity of decentralized exchanges such as Uniswap (Ethereum) and PancakeSwap (BSC), anyone can list a new token and start providing liquidity to it. So it was just a matter of time until token sales would take advantage of this.

So, in 2021, a new kid on the block rendered the above rather obsolete. Initial DEX offerings (IDOs) have taken center stage, so let’s have an in-depth look at what they are and everything you should know about them.

What is an Initial DEX Offering or IDO?

It’s worth noting that the original concept of initial DEX offerings has shifted tremendously over the years, and, in its current most popular form, it has little to do with what it was intended to be back when the first IDO took place.

In its essence, an initial DEX offering is a successor to ICOs and IEOs in that it aims to raise money and bootstrap a project. However, unlike ICOs and IEOs where the tokens are sold prior to the listing, with IDOs, they are listed immediately on a decentralized exchange (DEX) – hence, the name.

The first-ever IDO to take place happened in June 2019 – Raven Protocol. The team behind the protocol chose to use Binance’s decentralized exchange – the Binance DEX. They put up the token there at a specific price, and traders could buy it until the hard cap was reached. This is how the first few IDOs took place on the majority of platforms.

This particular way of fundraising had, in theory, a few powerful benefits, including:

- Fast trading

One of the benefits of an IDO is that the IDO coin can be traded immediately. This way, investors can buy their tokens quickly when it is launched and resell them at a higher price later during the IDO. For example, during the UMA protocol fundraising, the initial token price of $0.26 immediately jumped to just around $2.

- Immediate liquidity

As per proper definition, liquidity means the ability to buy or sell easily on the market. Or, in simple terms, how quickly you can get your hands on your cash. Here in the IDO, the project’s token gets access to immediate liquidity, which can benefit the token price.

- Open and Fair fundraising

Usually, it is observed that in the token offerings method, as soon as the token sale goes public, private investors buy a large number of tokens for a lesser price. They will resell these tokens to the general public gaining a huge profit. With the IDO fundraising approach, companies, especially startups, don’t need a centralized exchange and permission to kickoff the fundraising event. Also, anyone can organize or participate in IDO, not just private investors.

However, investors weren’t satisfied. The reason was that these token sales would essentially get bought up in a matter of seconds, leaving little chance for the average Joe investors to get a share and participate. The notion that they were getting scooped up by bots and insiders was born, and the industry had to adapt to satisfy the growing demand.

This led to the birth of IDO launchpad platforms – one of the hottest topics of late 2020 and 2021.

IDOs in Their Most Popular Form: How They Differ From IEOs?

In their most popular shape and form, nowadays, initial DEX offerings are particularly similar to initial exchange offerings (IEOs) with a few key differences.

With an IEO, it was the exchange vetting the project and conducting the token sale. With an IDO – it’s a third-party platform that’s vetting the exchange while the token sale itself happens in a somewhat decentralized fashion.

In theory, anyone can raise funds through an IDO with a third-party launchpad platform, as all they’d have to do is open a pool.

The way this works is fairly simple. A project goes to a launchpad, and if they meet their requirement, they are chosen to conduct an IDO. The process itself might vary from one launchpad to another, but the concept is always the same.

There is a pool where users can buy “IOUs” of the token that the project wants to launch. An IOU is an acknowledgment of debt. In other words, the investors pay for their tokens in advance but receive them upon the Token Generation Event (TGE), which usually happens very shortly after the IDO itself (typically within a few hours).

Once the IDO is successfully concluded, and the TGE takes place, the token is immediately listed for trading on a decentralized exchange. In most cases, this happens on Uniswap as the predominant number of projects are still built on Ethereum, and their tokens are based on the ERC20 protocol standard.

However, other blockchains are also growing in popularity, including Solana, Polkadot, and the Binance Smart Chain (BSC). This is why some projects prefer to have their tokens launched on them to avoid the high network fees on Ethereum. In this case, the token would be listed on native exchanges such as BSC’s PancakeSwap, for example.

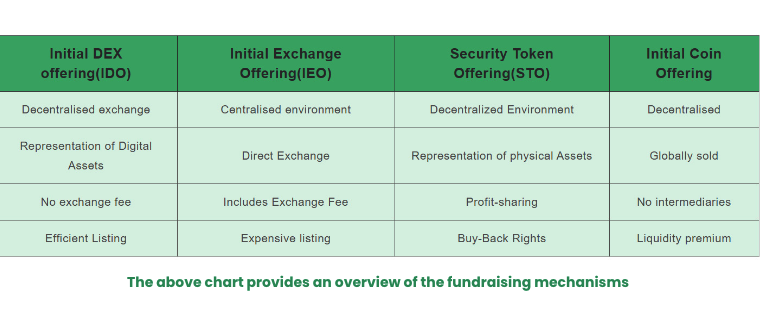

With this said, we can already see some differences and some similarities between ICOs and IEOs. Here’s a comprehensive comparative table:

ICO vs. IEO vs. IDO.

Very Low Initial Market Cap: Is This The IDO Secret Sauce?

Unlike initial coin offerings, especially during the peak of 2017-2018, IDOs typically have a very low market cap when their public listing happens. It’s usually just a few million or, in many cases, even less than a million. This is because of vesting periods for almost all token holders (including the team and seed and private investors) apart from those who participate in the actual initial DEX offering process.

The IDO process itself usually raises the smallest amount of money. As mentioned above, each participant can win an allocation of a few hundred dollars, and the total sum raised is rarely more than $500K.

What’s the point of this? There are a few things to consider:

Demand is likely to stay high during the price discovery. Hence, good projects can easily skyrocket to 10x just as they hit the markets.

From there, some projects have even gone another 10x, which provides a return of 100x for IDO participants. Even after a 100x, a project that started with a market cap of $3 million would be at $300 million, which is something reasonable.

This solves some of the ICO/IEO issues where investors rush to sell in profit and dump the price as soon as the token is listing – this could easily create a snowball effect.

The fundraising amount can still be high (a few million dollars or even more), but the initial circulating supply is what matters in terms of returns.

Multi-Chain IDOs, Multiple Launchpads: A New Trend

With the above in mind, it’s worth noting that there’s a growing trend where projects would launch their IDOs on multiple launchpads to capture more blockchains and a wider range of investors.

So, for example, a project would do one IDO on an Ethereum-based platform and another (or a few others) on other platforms built on Binance Smart Chain, Polkadot, Solana, or other networks.

This allows users to take their pick as to where they want to participate.

Win-Win: Investors Enjoy Huge ROIs While Project Gets Excessive Marketing

This is another typical part of basically every single initial DEX offering – the whitelisting process. Because the demand for those token sales is very high, the launchpad platforms can only allow a limited number of users to participate and provide them with a very limited size allocation, usually worth a few hundred dollars.

This is why every single IDO out there goes through an extensive whitelisting process that narrows down the participants to a supported maximum.

To be eligible for being whitelisted, users need to perform various marketing tasks, which oftentimes include:

- Join the project’s Telegram chat

- Retweet and comment on project’s tweets

- Like the project’s social media platforms and so forth

This creates a complete marketing storm that sees the growth of these communities exponentially. It’s not a surprise to see a future IDO project collecting over 100,000 followers on Twitter and just as many people in their Telegram groups in a matter of days.

Another shared criteria is for users to have to hold a certain amount of tokens that are native to the launchpad’s platform itself. For example, the popular IDO launchpad Polkastarter has two pools – one open for everyone and one where only POLS holders can participate. The competition in the latter is considerably smaller.

Typically, there would be two rounds of whitelisting: one for those who hold the launchpad’s native tokens and one for the wider public. Naturally, the second round sees astronomical competition, leaving inconsiderably small participation odds. This is why some platforms have moved to another token distribution model of guaranteed allocations.

Guaranteed IDO Allocations: What Are They?

To get an allocation in an upcoming IDO, most platforms now require their users to hold their own native tokens (as mentioned above) to increase the odds of participation.

To avoid lotteries, however, some platforms have decided to give guaranteed allocation based on the number of native tokens a user holds. Some examples include Kickpad, BSCPAD, TrustSwap, and so forth.

So, for instance, if an IDO wants to raise $100,000 and there are 1,000 qualifying participants, they would each receive $100.

However, to incentivize larger holders, launchpad platforms have also created tiers where the more of their tokens the user holds, the higher their allocation would be. This is why the prices of many tokens belonging to IDO launchpads have also increased in value substantially.

Pros and Cons of IDOs

As it is with everything, initial DEX offerings also have their advantages and disadvantages. Let’s have a closer look.

Advantages

Lower Costs

We all know that some exchanges ask several thousand up to one million dollars to list a project’s token. On top of that, many exchanges are picky about the tokens they list. We could argue this is some sort of censorship. However, that’s outside of the scope.

If a project uses a liquidity exchange, they only pay a few euros of gas fee for deploying a new smart contract. This smart contract controls the liquidity pool and the asset’s token

Virtually every project can raise money.

Removing the vigorous vetting procedures of IEOs has given plenty of projects access to crowd-sourced capital, which, in theory, benefits the wider industry. Of course, this can also be a disadvantage.

Flexibility

Investors don’t have to wait long periods of time for the tokens to be listed on an exchange. The listing usually happens immediately after the IDO is completed, allowing them the flexibility to cash in on their investment quicker than it was with ICOs.

Instant and High Liquidity

It has become a practice for most of the projects to lock a considerable portion of their crowd-sourced funds as liquidity on the DEX where the token starts to trade. On top of that, many projects will immediately offer staking programs to incentivize holding.

Transparency

Because everything happens on-chain, there’s traceability, and everyone can verify the token contracts in advance (if they are public, of course).

Disadvantages

Obscure Vetting Process: Ground for scams

In continuation of the first advantage, the fact that there’s such a high demand for IDOs also allows scam artists to create obscure projects and have them bootstrapped fairly quickly.

Expensive Participation Criteria

While most platforms have a public round where anyone can participate, the odds of winning an allocation are practically non-existent because of the sky-high competition. This is why users have to hold a large number of launchpad tokens to get a sizeable investment and a proper return.

Liquidity Rug Pulls

Lastly, let’s discuss the problem of liquidity rug pulls. Investors have to decide quickly if they want to invest in a new swap listing as the price starts to move immediately.

This gave scammers the opportunity to list fake tokens that have a similar ticker symbol to the original token. Next, these fake listings try to acquire some initial liquidity so that the token creators can run away with the collected Ethereum from the liquidity pool. This type of liquidity rug pull leaves investors behind with a worthless token.

Unproportional bag holding between seed, private and public investors

Most IDOs will keep the majority of the tokens for the team and seed/private round investors. As mentioned above, the vesting over time assists in preventing a price discovery dump of the token. However, once the unlocking dates as per the vesting schedule are reached, this almost always results in massive profit-taking. Pro tip: by tracking smart contracts, investors can easily see when such an event takes place (usually once a week, once a month, or once a quarter).

No KYC integration

There is no KYC integration, which means no validated information on the investors.

How to Invest in an IDO?

Participating in an IDO is a process that can vary depending on the launchpad of choice. However, there are a few requirements that most projects tend to follow, regardless of the launchpad.

1: Perform KYC/AML if requested

More and more IDOs require their investors to perform a KYC/AML screening procedure before allowing them to participate. This is done because the regulatory framework for cryptocurrencies in the majority of countries has become a lot more stringent. To avoid any potential legislative issues, almost all IDO projects conduct a KYC. This is also the reason for which US citizens are rarely allowed to participate.

2 (Optional): Hold Launchpad Tokens

This is also something that almost every launchpad platform requires potential investors to do. If they want to be eligible for an allocation, they must hold a certain number of its tokens or provide liquidity in some shape or form.

As mentioned above, sometimes it increases the chances of winning an allocation.

3: The Whitelisting Process

As mentioned above, to be eligible for an allocation, users need to be whitelisted. Apart from a KYC check-up, they also have to perform various tasks such as following certain pages on Twitter, retweet certain posts, and join specific Telegram groups.

4: Have a Web 3.0 Wallet Ready

To participate in an IDO, users have to interact with the launchpad platform to first invest and, second, to receive their tokens.

There are plenty of options out there with the most widely used wallet, also one of the most reputable, being MetaMask.

If you don’t have any Web 3.0 wallet and don’t know how to use it, please read my Metamask Complete Guide here 🙂

5: Learn How to Use Uniswap and Other DEXes

Assuming you manage to get an allocation and receive the tokens in your wallet, you would want to start trading them eventually.

To access the immediate listing, you should familiarize yourself with how Uniswap and other decentralized exchanges work. I’ll be covering Uniswap and how it works shortly.

The Most Popular IDO Launchpad Platforms

Polkastarter

Polkastarter can be considered as the pioneer in the launchpad field because it’s amongst the first platforms out there. It is also currently the biggest one.

This is probably one of the more interesting platforms and cryptocurrencies. Having already established a strong user base it is one of the leading lights in the space. It is also looking to use its credibility and large investor base to diversify into other areas — the first one being DeFi insurance. Polkastarter’s token has a valuation of $236 million and a fully diluted valuation of $370 million. This is probably a billion dollar plus platform when you compare it to its rivals in the same space, PancakeSwap and Uniswap.

DuckSTARTER by DuckDAO

DuckSTARTER is the launchpad platform of DuckDAO, and it’s also one that receives serious attention from investors. It has successfully bootstrapped many projects and continues to see serious interest.

BSC Pad

The BSC Pad is the first launchpad built for projects on Binance Smart Chain. It’s also interesting that users receive guaranteed allocations based on the number of BSCPAD tokens they hold, eliminating the lottery process but also reducing the size of the allocation based on the fundraising goals.

DxSale (SALE)

This project has a market cap of $8 Million and a fully diluted valuation of $27 million. Despite a 3,600% rise in price in the last six months the valuation is modest based on its performance and potential. The DxSale platform has raised $3 million for over 1,400 projects accumulating $300 million in TVL (Total Locked Value) since December 2020. DxSale has taken a different approach to many of its competitors by introducing controls to prevent rug pulls. Its main downside is that it has an anonymous team, however balanced against the rapid progress it has made and its modest market value, this is a coin to conduct further due diligence on.

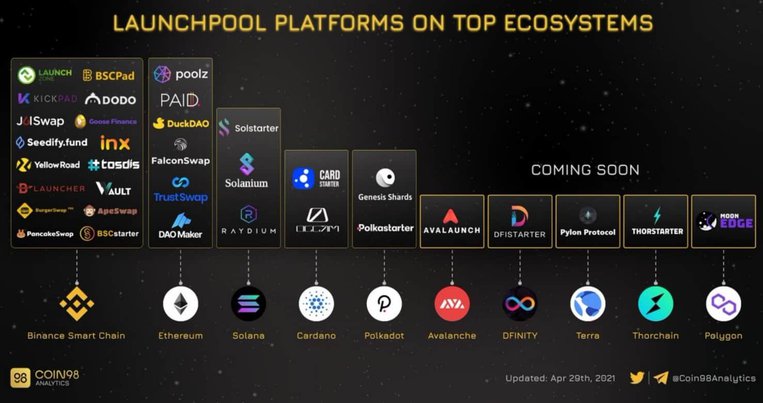

Of course, these are some of the more popular launchpads. Below is an infographic from Coin98 Analytics.

Wrapping up

The IDO is relatively new by crypto standards. Polkastarter, a leading player, was only established in December 2020 and has already amassed 200,000 investors. There have definitely been some mouth watering returns generated from IDOs however the sector is not without its problems. The biggest complaint is that investors are unable to participate or that prices move so rapidly they end up paying multiples of the listing price.

We have to remember that IDOs are young and that they are a far from perfect solution to the crypto fund raising dilemma but they are definitely a step in the right direction. The concept should only grow stronger making this a great area to look for gems and earn substantial returns. However as always make sure you are spreading your risk among a number of projects as not all projects will turn out to be as positive as the examples I have cited above.

As always feel free to leave a comment down below for any question you have about this article and I’ll be answering! Remember, we are all here to learn and there are no stupid questions

Thank you !