Bitcoin’s Price to Stagnate or Decrease Short-Term as Exchange Inflows Increase: Analyst

Bitcoin investors have started to deposit substantial amounts of their portions into exchanges, on-chain data shows. Consequently, a popular analyst expects the asset’s price to stay at current levels or, most probably, to keep dumping in the following days.

Bitcoin Whales’s Deposits to Exchanges Skyrocket

Bitcoin’s price was on a wild rollercoaster ride in the past week or so with Elon Musk receiving most of the blame. After he and Tesla announced that customers can no longer purchase electric vehicles with BTC, the asset went on a downfall.

In days, the primary cryptocurrency fell by more than $15,000, resulting in reaching a new three-month low at just over $42,000.

Aside from the short-term price impact, Musk’s words also spurred the community into a continuous debate about BTC’s features, energy consumption, efficiency, and more. This may have caused more serious disruptions for bitcoin investors, especially in the short run.

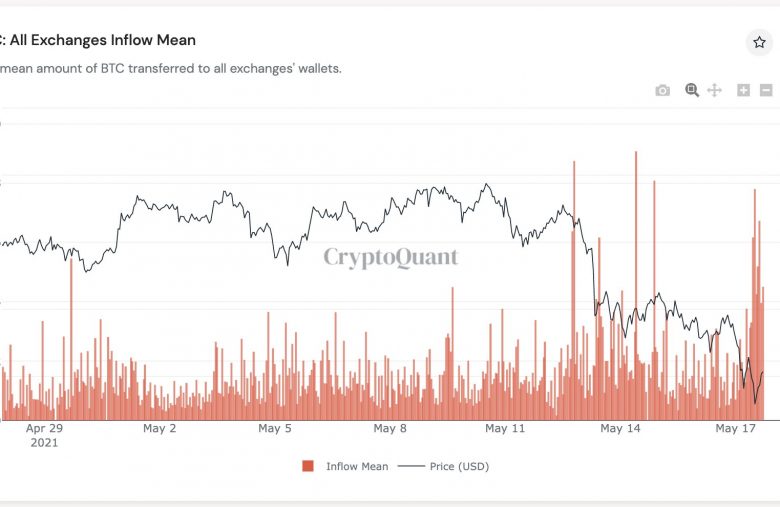

Data from CryptoQuant suggests that holders have started to deposit larger portions of their BTC stash to exchanges. Consequently, the analytics firm’s CEO, Ki Young Ju, predicted that the bearish price developments may continue.

$BTC seems likely to consolidate in a wide range or be bearish in a few days.

— Ki Young Ju 주기영 (@ki_young_ju) May 17, 2021

The average amount of $BTC deposits is significantly increasing again.

This is a pretty unusual situation. Don't take too much leverage on your longs. Be careful.

Chart👉https://t.co/N4snAUDSgf https://t.co/ASGhe0AuuR pic.twitter.com/uuK2rLG7cZ

Bitcoin All Exchanges Inflow. Source: CryptoQuant

Who Is Selling?

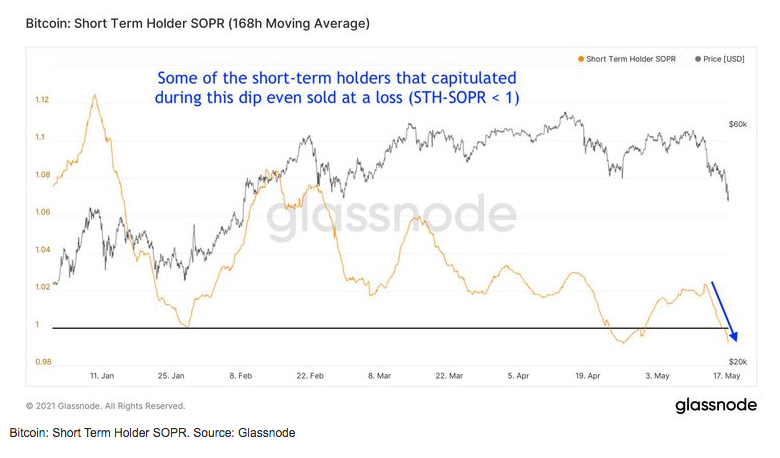

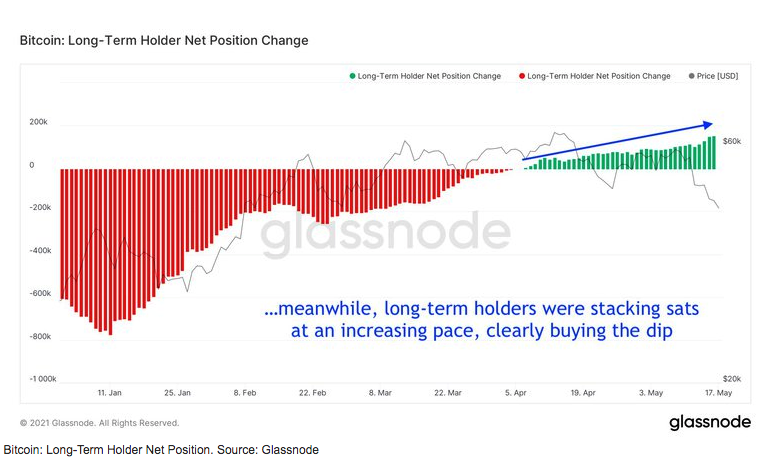

On-chain data from Glassnode shows that during this sizeable correction, which saw BTC’s price retrace by over $20,000 from its peak, short-term bitcoin investors were the ones who disposed of their positions. In contrast, longer-term investors, also referred to as HODLers, have kept accumulating even as the price retraces.

The story of this #Bitcoin dip in 4 charts ⛓️

— Dilution-proof (@dilutionproof) May 17, 2021

Most of the on-chain volume came from short-term holders that ended up capitulating at a loss 🪦

Meanwhile, long-term holders & miners are stacking sats at an increasing pace, clearly buying the dip 💪 pic.twitter.com/TSa37T17nV

By examining the Short Term Holder SOPR (wallets with UTXOs with a lifespan of less than 155 days), the analytics company’s data shows that such investors have capitulated in the past several days and have ever sold at a loss.

At the same time, the Long-Term Holder Net Position metric has risen, indicating that these investors have increased their bitcoin positions.

Bitcoin miners have also refused to sell as their holdings have grown since early April. They were most actively selling until the end of January.