The Rise of MEV in Ethereum – Technical view

MEV is an abbreviation of “Miner Extractable Value” or “Maximal Extractable Value.” It refers to profits that can be made by extracting value from Ethereum users by reordering, inserting or censoring transactions within blocks being produced. It typically affects DeFi users interacting with automated market makers and other apps.

MEV is one of Ethereum’s biggest issues, with more than $689 million extracted from users of the network year-to-date.

If you still don’t know what MEV is, I wrote a complete guide here: “What Is MEV? Ethereum’s Invisible Tax Explained“.

Data for this article was taken from Etherscan & Flashbots between blocks 11834049 and 12196601 on Ethereum.

Maximal Extractable Value (MEV — previously, Miner Extractable Value) has cast a theoretical shadow over Ethereum and other smart contract blockchains since the release of Flash Boys 2.0 in 2019. In 2020, the thriller-worthy Ethereum is a Dark Forest blog post brought to light how theory had become reality on-chain.

Have a read here “Ethereum is a Dark Forest“

While a terrifying reality, the extent of MEV was not yet clear to all. Enter Flashbots, a collective looking to increase transparency and democratize access in the depths of Ethereum’s dark forest. Since late 2020 they have steadily been expanding MEV awareness across the wider community, including their release of MEV-Geth.

Then, as the debate around EIP-1559 peaked in February, a community call on the proposal brought even more attention to MEV to the crucial demographic of miners. The prospect of having juicy transaction fees taken away by EIP-1559 plus a simple upgrade option in MEV-Geth made the appeal of MEV alluring for many miners, leading to mining pools’ (observable) participation in MEV shooting up in recent weeks.

What do MEV-extracting transactions look like?

Before we get into the rapid growth of MEV, it’s useful to first unpeel what MEV-extracting transactions look like. Most MEV involve manipulating the order of transactions. These could be done by:

- Bidding gas fees that are above or the same as a target transaction’s to ensure your transaction goes through before or after it; or

- Tipping a miner to directly arrange transactions in a mined block to your selection

In the case of #1, you may detect them when seeing one or more failed transactions with either the same or very slightly lower gas price used than a successful one right before it. The failed transactions indicate a ‘victim’ or other arbitrage bots losing out.

For #2, these can be seen when a mined block has one or more transactions with extremely low gas price such as 0 or 1 gwei.

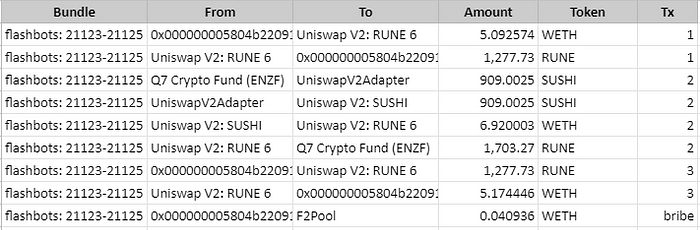

While in many cases the exact workings of the transactions above may not be clear (such as the tip amount in #2), for Flashbots transactions these are transparent and can be viewed by summing the ins & outs of the relevant addresses in a given bundle of transactions.

For example, by listing down the exact token and ETH transfers of the first 3 transactions in block 12165347…

…and summing up the net inflow and outflow for each address and token, we can see that the arbitrage bot 0x000..241 and F2Pool earn an equal split of 0.04 ETH in arbitrage profits here.

Up-only traction

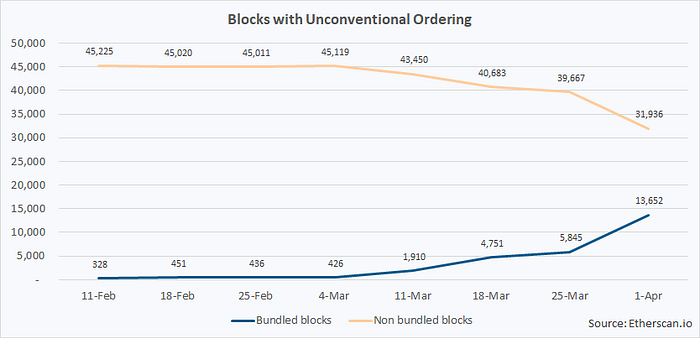

Using data from Etherscan, Flashbots and an address identified as Ethermine’s, we see that the number of blocks with unconventional ordering have grown tremendously over the last month.

Note: Blocks with unconventional ordering refer to those with transactions that have not been ordered in the typical manner (ie from highest to lowest gas price), typically as part of exploits such as front running, back running, or sandwich attacks.

Put another way, they made up 30% of all blocks mined in the first week of April!

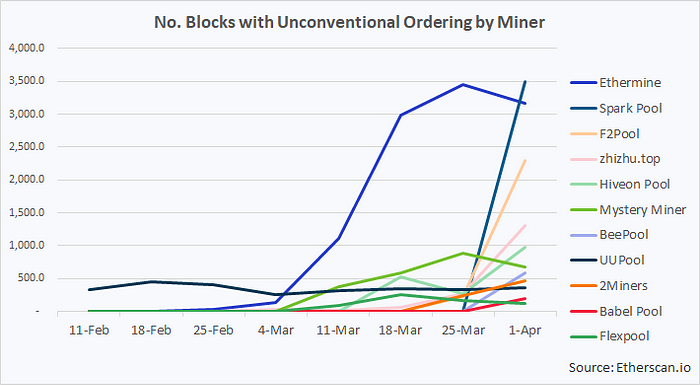

Who are the mining pools participating? The list of pools include almost all the top mining pools in Ethereum. Prior to March, UUPool was the only one active. They have since been eclipsed by the largest pools coming online in recent weeks.

Note: Ethermine is the only pool in the list not utilizing MEV-Geth, running their own MEV beta.

Revenue extracted

From these mined blocks, we can see the total ETH tip to each miner. 3,404 ETH in total have been paid, equivalent to $7.4 million at the time of writing. This is still a tiny fraction of the ~797,000 ETH in transaction fees over February-March (~0.4%). MEV extracted by miners have much more room to grow still.

Note: Since Ethermine isn’t using MEV-Geth, their tip revenue isn’t observable on-chain and not included here.

A separate look at total extracted MEV from Ethereum (not just those using Flashbots MEV-Geth) using Flashbots’ MEV-Inspect shows more than $350 million have been extracted from the network.

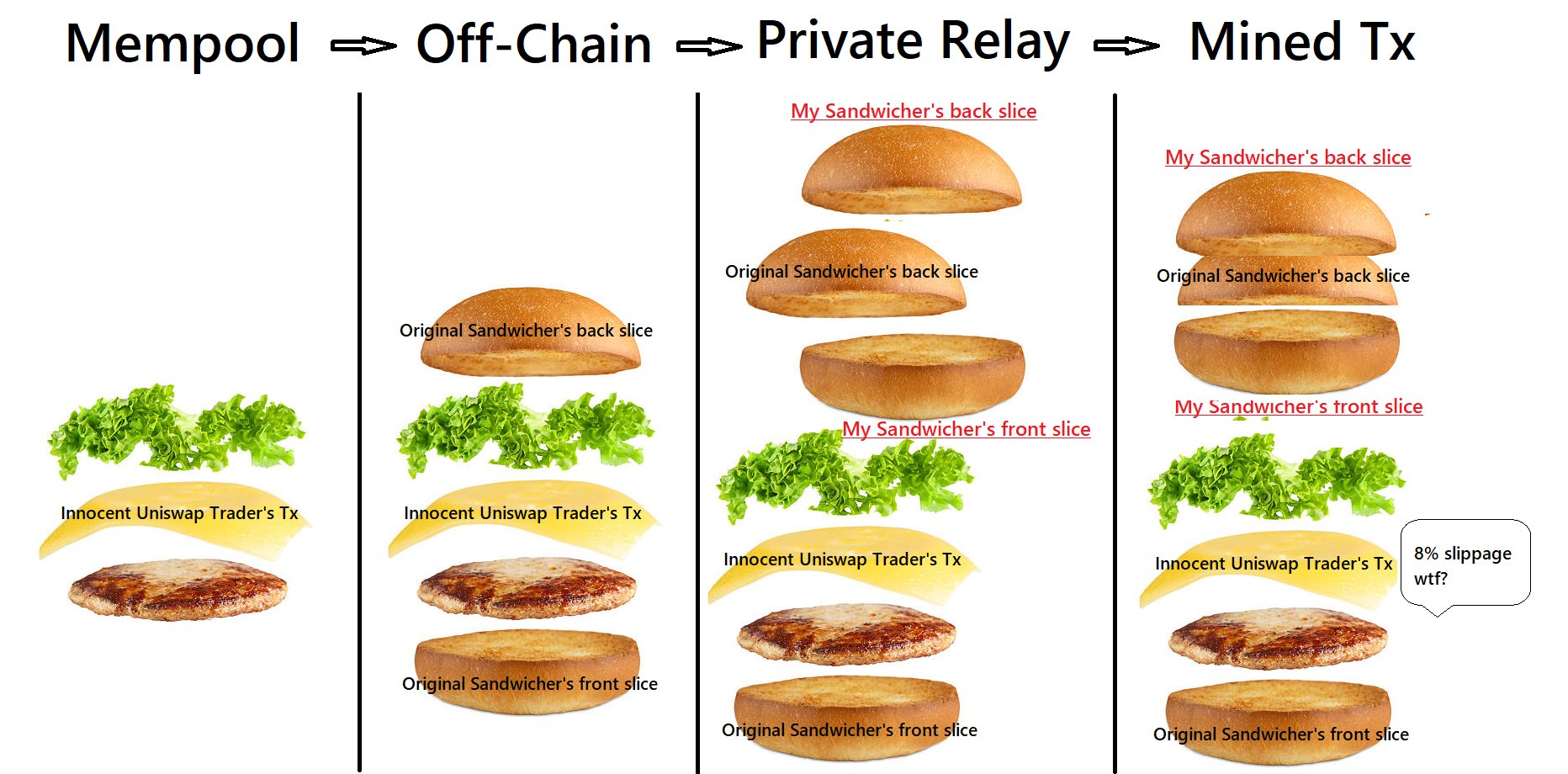

Sandwiches, the most popular flavor

Finally, we take a look at the number of Flashbots transactions in a block. By far the highest number is three transactions, which indicates that sandwich attacks are the most prevalent type of MEV activity (typically #1 and #3 are arbitrage transactions targeting #2, a transaction by someone else).

The block with highest recorded MEV transactions has fifteen of them in one block, comprising 5 sandwich attacks on swaps made with Uniswap.

Fascinatingly, sandwich attacks themselves may be sandwiched, making for endless possibilities for smart predators in the dark forest.

Whitepaper below on an automated whitehat sandwicher that sandwiches other notorious sandwichers. pic.twitter.com/JmbmbEdofQ

— Fiona Kobayashi 🧠 (@fifikobayashi) March 16, 2021

It’s important to note that all of the MEV data shown above is a lower bound or subset of total possible MEV. Actual numbers may be far larger than what has so far been unearthed.

What can we do against such reckless MEV?

For the average user, MEV is unlikely to be a worse problem than the current exorbitant gas prices. An AMM transaction with high value may attract the attention of MEV predators — in such cases, limiting slippage may help to deter or limit attacks. Using private transaction services such as Flashbots or Taichi Network may also help, although the user will need to trust the service’s operators to not front run them too.

On Etherscan’s side, we hope to contribute to increased transparency of MEV by displaying more details on the block explorer. Look out for these coming soon!