First, before reading this post make sure to read the Decentralized Finance complete guide for beginners.

We saw that Decentralized finance in blockchain is made up of multitud of decentralized, non-custodial financial products. They include decentralized exchanges, lending and borrowing protocols, synthetics derivatives and much more.

In a traditional savings account, you put money into the bank and earn interest on that money. The problem is that regular bank customers are not able to use their deposited, interest-earning money in any other way once it’s in the bank. What if you could spend the money your savings earned while still saving? That’s an idea DeFi, or decentralized finance is hoping to solve.

According to metrics site Defi Pulse by March 2021 just $40.89billion worth of cryptocurrencies were locked up in Defi protocols. Let’s explore together the current leading DeFi protocols.

Decentralized lending protocols and yield farming

DeFi lending and borrowing platforms like AAVE, Maker and Compound are by far the most popular kinds of DeFi projects. As we’ve mentioned, these platforms allow anyone to lend or borrow as long as they have the appropriate crypto assets to loan out or use as collateral.

Borrowing allows one to leverage their capital to accomplish tasks, while lending allows one to earn a regular and safe return on their otherwise-idle capital.

COMPOUND (COMP)

Compound Finance is a place where you can lend or borrow cryptocurrencies. Consider it as savings account where you can earn interest without having to trust a third party with your funds. All you need is an Ethereum wallet, some funds, and you can borrow or earn interest right away. Both lenders and borrowers get even more value from their crypto.

Lenders earn interest, while borrowers deposit crypto to gain access to credit without the banking headaches.

Compound Finance works differently from other types of loan markets.

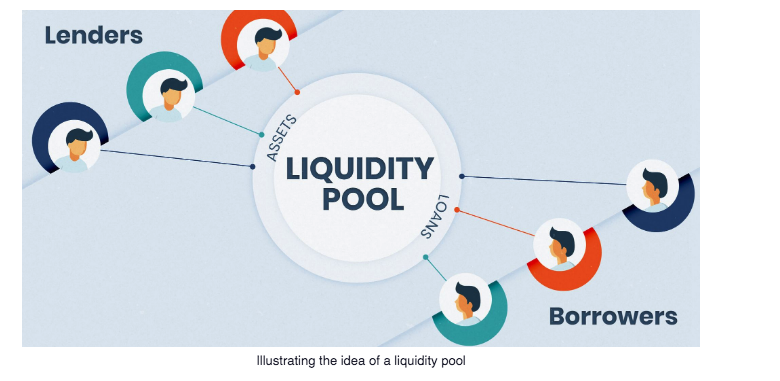

As a lender, you don’t lend money directly to a borrower. You lend assets to the Compound Finance “liquidity pool”, from which borrowers can borrow assets.

The liquidity pool is not the Compound Finance team, a bank, but a series of smart contracts. These smart contracts automatically match borrowers to available assets.

Compound focuses on allowing borrowers to take out loans and lenders to provide loans by locking their crypto assets into the protocol.

The interest rates paid and received by borrowers and lenders are determined by the supply and demand of each crypto asset. Interest rates are generated with every block mined. Loans can be paid back and locked assets can be withdrawn at any time.

The interest rates for supplying and borrowing on Compound are adjusted algorithmically through smart contracts. This means that the Compound protocol automatically adjusts them based on supply and demand.

Compound’s native token cTokens that allows users to earn interest on their money while also being able to transfer, trade, and use that money in other applications.

3 facts thant might interest you:

- There is no minimum for either lending or borrowing

- Lenders earn interest about every 15 seconds (every Ethereum block)

- You can use Compound for as long as you like, without any penalties.

It seems complicated to understand at first, but don’t worry. I’ll be covering Compound and how to use it in an article.

See Compound’s website here.

AAVE

Aave is like Compound another Ethereum-based money market where users can borrow and lend a wide variety of digital assets, from stablecoins to altcoins. There is a wide variety of cryptocurrencies to choose from, and Aave offers both stable and variable interest rates to its users.

To transact on Aave, lenders must deposit funds into liquidity pools, and users can then borrow from these pools. Each pool sets assets aside as reserves to hedge against volatility. These reserves also help ensure that lenders can withdraw their funds when they’re ready to exit the protocol.

Aave has close to 20 different cryptocurrencies available for lending and borrowing. Included in some you may have heard of: DAI, ETH, BAT, LINK, MANA, MKR, SNX, USDT, USDC, TUSD, USDT, sUSD, BUSD, KNC, LINK, wBTC, ZRX, and of course, LEND. Not all of the cryptos can be used as collateral.

Perhaps one of Aave’s most impressive features are flash loans.

More often than not, there is much more liquidity in Aave’s money-market pools than loans required by borrowers. This unused liquidity can be used by those that take flash loans.

Flash loans are a huge selling point for Aave, and users don’t need any collateral to access them.

Instead of collateral, there are time requirements. In other words, a flash loan allows a user to borrow a large amount of cryptocurrency without posting collateral, then return the loan within the same transaction. If not, the entire transaction will fail.

Flash Loans are futuristic and next-generation DeFi. They are Aave’s most significant contribution, and they hold incredible potential. Since the code is open-source, other developers will be able to offer them on their platforms. And Flash Loans are native to the crypto space which means that it’s an entirely new feature. We won’t find anything similar in the traditional financial world.

If you are interested in AAVE, you can track its growth with Aave Watch. If you are interested in using AAVE just let me know in the comment section and I’ll write a ” step by step AAVE – complete guide” in which I’ll cover everything from how to use the platform, how to borrow, how to lend, the risks involved… EVERYTHING.

Website here

UNISWAP (UNI) – DECENTRALIZED EXCHANGE

Uniswap is a cryptocurrency exchange run entirely on smart contracts, letting you trade popular tokens directly from your wallet. This is different from an exchange like Binance or Coinbase, which stores your crypto for you and holds your private keys for safekeeping. Uniswap uses an innovative mechanism known as Automated Market Making to automatically settle trades near the market price. In addition to trading, any user can become a liquidity provider, by supplying crypto to the Uniswap contract and earning a share of the exchange fees. This is called “pooling”.

3 facts that you need to know regarding DEX (Decentralized exchange)

- Anyone can trade on DEX – There is no KYC in a DEX whcih means that everyone can access it and trade on uniswap

- Decentralized exchange are more difficult to shut down

- Listing coins is easy

I’m covering Uniswap in this article. Have a read if you want to know what it is and how to use it.

Website here

MAKERDAO (MKR) – Stablecoin

Maker is a stablecoin project where each stablecoin (called DAI) is pegged to the US Dollar and is backed by collateral in the form of crypto. Stablecoins offer the programmability of crypto without the downside of volatility that you see with “traditional” cryptocurrencies like Bitcoin or Ethereum.

MakerDAO has two tokens, MKR and DAI. The DAI is a stablecoin designed to provide an alternative to more volatile cryptocurrencies, as well as a new type of financial system. The MKR meanwhile, is used to keep the DAI stable. Traditional stablecoins use reserves of fiat currencies or even gold to peg a cryptocurrency to the value of these real-world assets to keep it stable. But that has proved problematic. MakerDAO uses the MKR token to act as a counterweight to price fluctuations.

But how does it work?

The price of DAI is kept in check through a system of smart contracts automatically executing themselves. If the price of DAI fluctuates too far from one dollar, Maker (MKR) tokens are burned or created in order to stabilize the price of DAI.

I know it seems like overwhelming right now, please use the comment section below to ask me anything you need.

SYNTHETIX (SNX) – Synthetic Assets

One of the challenges with DeFi is bringing real-world assets (like fiat currencies) on-chain, meaning in the blockchain.

Synthetix is a platform that lets users create and exchange synthetic versions of assets like gold, silver, cryptocurrencies and traditional currencies like the Euro. The synthetic assets are backed by excess collateral locked into the Synthetix contracts.

Synthetic assets or “Synths” copy the price of an asset in the “real world” and brings it onto the Ethereum blockchain giving that Synth all the properties of an ERC20 token.

Don’t worry I’ll be covering Synthetix platform fully in an article.

AUGUR – Prediction Markets

Augur is a decentralized prediction market protocol. Prediction markets are popular financial tools that can be used for, you guessed it, predicting events like election outcomes, sport…

Decentralized prediction markets have some benefits over their centralized cousins, including censorship resistance. For example, betting on sports events in jurisdictions where that isn’t allowed can be made possible with DeFi prediction markets.

Augur’s website here.

Polymath- Issuance Platforms

Issuance platforms decentralize things like the issuance or creation of securities, which would normally require middlemen like investment bankers.

The DeFi equivalent of the securities market is the security token market. Security token issuance platforms like Polymath provide solutions for issuers to create, issue, and manage digitized securities.

Issuance platforms can make orders of magnitude easier (and cheaper) for companies to raise funding by eliminating middlemen like investment bankers and lawyers. It can also open up investment to a much broader pool of investors (basically the entire world, depending on who the offering is open to). Whereas traditional security offerings are limited to investors who have a trading account with the exchange where a security gets listed (e.g. the New York Stock Exchange).

I’m currently developing a Security Token Platform (STO) on Ethereum. I’ll be covering security tokens in an article.

Enzyme Finance (MLN) – Asset Management

Asset management, which is huge in the legacy financial system (Fidelity Investments, one of the largest asset managers in the world, has $2.46 trillion in assets under management alone), is another space that DeFi aims to disrupt.

Although DeFi asset management is nowhere near as big as that of traditional finance, there are projects like Enzyme Finance that offer decentralized asset management solutions. Enzyme users can both manage their wealth and that of others in the form of ETH and ERC20 tokens.

In a nutshell, Melon Protocol allows individuals or organizations to manage their wealth and the wealth of others on a decentralized asset management platform.

PoolTogether – a No Loss Saving Game

Blockchain and DeFI here bring infinite new possibilities. PoolTogether is a no-loss game where participants deposit the DAI stablecoin into a common pot. At the end of each month, one lucky participant wins all the interest earned, and everyone gets their initial deposits back.

PoolTogether website here

I have been covering here the main usecases DeFi is offering us now.

The banking and financial industry is one of the major sectors that is going to be impacted by blockchain. The potential use cases are plenty, from real-time transactions to tokenization of assets, lending, smoother international trade, more robust digital agreements, and many more.

DeFi proposes solutions to give economic power back to the people by creating a financial system that is accessible, efficient, and transparent.

As I have already written, nobody is truly free unless they have financial liberty. We are at the birth of a global financial revolution.

As always feel free to leave a comment down below for any question you have about this article and I’ll be answering! Remember, we are all here to learn and there are no stupid questions

Thank you !