How to profit with cryptocurrencies

Hey everyone! I’ll be covering different ways to profit with cryptocurrencies if you’re an hodler.

If you don’t know what a hodler is, a hodler is anyone who invests in crypto in the long term. I’ll be covering the difference between investment and trading in the trading section of the website.

Hodling is a cryptocurrency investment strategy that disregarded trading based on short-term price fluctuations.

Hodlers simply stay away of all this volatility and hold. This helps them to counteract two common and quite destructive actions in trading: FOMO (fear of missing out), which can lead to buying high, and FUD (fear, uncertainty, and doubt), which can lead to selling low.

What if you could be utilizing your cryptocurrency in a passive or low-risk manner? There are numerous options available to HODLERS, each having its own factor of risk attached.

Let’s see how you can generate passive incomes with your cryptos.

Staking

In cryptocurrency, staking is the process of acquiring cryptocurrencies and keeping them locked in a wallet in order to receive profits or rewards. It is a process very similar to the HODL, only that at stake the balances are blocked and you cannot use them freely, in favor of receiving a certain annual interest for said practice. You can stake cryptocurrency tokens for passive income on many public blockchains that operate using the Proof of Stake (POS) protocol.

Typically, staking involves setting up a staking wallet and simply holding the coins. In some cases, the process involves adding or delegating funds to a staking pool. All you have to do is keep your tokens on the exchange and all the technical requirements will be taken care of.

The reward amount is dependent on the number of crypto tokens held in their wallets and they are paid for their contribution to the smooth running of the network.

The annual reward for staking can vary from 5% to 52% depending on the protocol.

In the long-term, this has proved a far more popular method because there is a higher chance of everyone getting compensated with a passive income. Unlike Proof of Work where only large scale miners earn good incentives. Staking has also encouraged crypto enthusiasts to hold on to tokens for a longer amount of time, adding more buoyancy to the ecosystem.

Staking is an excellent way to put your crypto to work and make a passive income. Knowing the right cryptocurrencies as well as the most profitable staking systems is the key. This will ensure you earn the highest amount of dividend possible for your work.

Liquidity Pools

Liquidity pools are one of the foundational technologies behind the current DeFi ecosystem. They are an essential part of automated market makers (AMM), borrow-lend protocols, yield farming, synthetic assets, on-chain insurance, blockchain gaming – the list goes on.

In itself, the idea is profoundly simple. A liquidity pool is basically funds thrown together in a big digital pile. But what can you do with this pile in a permissionless environment, where anyone can add liquidity to it?

I won’t cover what is a liquidity pool and why we need them in blockchain, since I will write a full article about it but I’l explain how you can make passive income from it.

Liquidity pools, in essence, are pools of tokens that are locked in a smart contract. They are used to facilitate trading by providing liquidity and are extensively used by some of the decentralized exchanges a.k.a DEXes.

One of the first projects that introduced liquidity pools was Bancor, but they became widely popularised by Uniswap.

In its basic form, a single liquidity pool holds 2 tokens and each pool creates a new market for that particular pair of tokens.

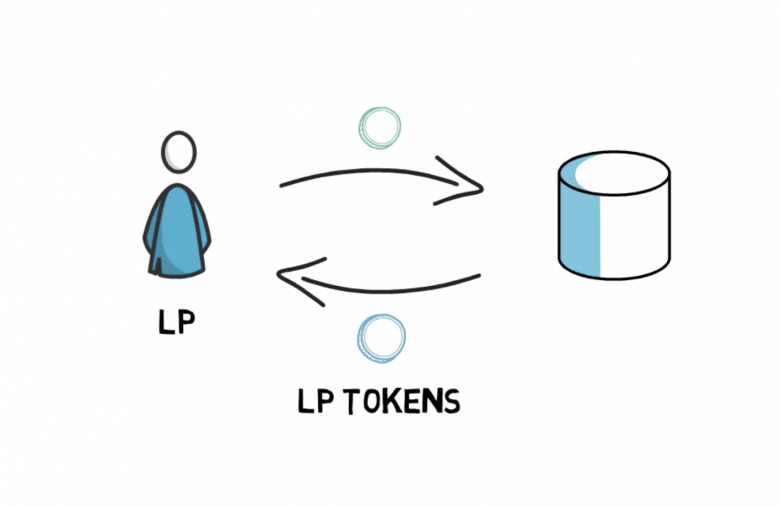

When liquidity is supplied to a pool, the liquidity provider (LP) receives special tokens called LP tokens in proportion to how much liquidity they supplied to the pool. When a trade is facilitated by the pool a 0.3% fee is proportionally distributed amongst all the LP token holders. This is your passive income.

Liquidity pools are one of the core technologies behind the current DeFi technology stack. Don’t worry, I’ll be covering Liquidity pools in a separate article.

Yield Farming

But what is that? Yield Farming?…. Yes 🙂

Yield farming is a way to make more crypto with your crypto. It involves lending out cryptos via DeFi protocols in order to earn fixed or variable interest. In return for your service, you earn fees in the form of crypto.

Put your crypto to work and earn passive income

Simply put, yield farming involves lending cryptocurrency via the Ethereum network. When loans are made via banks using fiat money, the amount lent out is paid back with interest. With yield farming, the concept is the same: cryptocurrency that would otherwise be sitting in an exchange or in a wallet is lent out via DeFi protocols (or locked into smart contracts, in Ethereum terms) in order to get a return.

Yield farming – also referred to as liquidity mining – is a simple concept but not an easy one in practice. Yield farmers will use very complicated strategies. They move their cryptos around all the time between different lending marketplaces to maximize their returns. They’ll also be very secretive about the best yield farming strategies. Why? The more people know about a strategy, the less effective it may become. Yield farming is the wild west of Decentralized Finance (DeFi), where farmers compete to get a chance to farm the best crops.

They are numerous money markets in such as Compound or Aave and these provide the most straightforward road to earning a yield.

I covered briefly Compound, Aave and some other DeFi usecases in the article here.

I’ll be writing a complete guide for Yield Farming in an article. Don’t worry 🙂

Blockchain Games

If you’re into videogames you will like this part 🙂 Let’s be honest with you guys, I’m NOT into videogames and I love it !!!

With the blockchain technology and blockchain games come true ownership. This true ownership means that whatever you’ll make in the game you will own it 🙂

Decentraland, Sandbox.. are few blockchain games you can play while making money and earning cryptocurrency in games. Both Decentraland and Sandbox are games that operates on the Ethereum blockchain. Those games are owned by us, the community. By developing your own gaming concepts, such as levels, lands (a digital piece of real estate), and items to sell in the in-game marketplace, you can earn revenue while enjoying a growing online gaming community.

You will soon be able to build things in VR too!

As I said in those games you can buy lands that will allow you to monetize your gaming experiences in various ways. You can choose to charge others to visit your land, to play your games, or potentially rent your land for a virtual event or sell your lands at a profit after you customize it. Buying a LAND allows you to build a gaming world that you fully own and control. Whatever you will buy and build in those games is indisputably yours forever unless you choose to sell it or give it away. These items like virtual real estate, digital sneakers.. are called NFTs (Non Fungible Token). Read my NFTs complete guide for beginners here.

An NFT ( Non-Fungible Token ) is a special token representing a unique ID that cannot be replicated, they are used to create verified digital ownership and are used in applications that offer Crypto Art, Crypto Gaming, Crypto Collectibles & more.

“When we first started working on Age of Rust, we decided to do a crypto treasure hunt and set aside 24 BTC, which was worth around $20,000 at the time. We had no idea that it would grow to become such a huge bounty so fast,” said Chris LoVerme, CEO of SpacePirate Games.

Age Of Rust is another blockchain-based game that will allow users to earn cryptocurrency in-game. This one is based on the Enjin protocol. But, pay attention here my friends!

Last March 19th Age of Rust was set to launch on steam and for the “opening” a Treasure Hunt will take place. YES! Age of Rust players will have a chance of finding 24 Bitcoin (BTC) and 370,000 Enjin Coin (ENJ) hidden within the 250,000km2 digital universe.

Every player will have an equal chance to find the main 20 BTC (~$655,000) bounty at the end of the three seasons, with another 4 BTC and 35,000+ smaller bounties to win along the way.

24 BTC today is worth: $1.130.000 🙂 Let me tell you this game will be crazy!

I’ll cover blockchain gamings and NFTs in a Gaming Series post, don’t worry 🙂

By the way, to be able to play a blockchain game you’ll have to connect your MetaMask. Read my MetaMask step by step and complete guide here 🙂

Airdrops

Another way of getting cryptocurrencies for free are Airdrops. A crypto airdrop is a giveaway from a blockchain startup to attract a crowd. Often this requires a little social engagement to receive your free cryptos like sharing a tweet or joining a Telegram channel.

Projects are only successful if they can attract and maintain an active user base. An airdrop is basically a marketing strategy to raise awareness of a new currency.

But since the blockchain industry is still wild, you have to be careful to not be scammed. With the crypto space growing every day and new ways for tokens to be distributed being developed continuously. You can avoid getting scammed essentially by doing some research when taking part in cryptocurrency airdrops.

When taking part in a cryptocurrency airdrop, these 3 things are the things that you should never do:

- Never send your private keys

- Never send money to any address! Legitimate airdrops will never ask for this.

- Do your own research and check if the sources are official.

In a decentralized world you are 100% responsible of what you do or what you lose. There is no third-party you can call to reclaim whatever you have to reclaim if you lose your private keys or send wrongly cryptos to someone. I’m building these contents and this community for you to be safe 🙂

Here we are! I’ve been covering different ways to profit with cryptocurrencies without trading. Blockchain is a new, disruptive and fascinating world and the best part is yet to come.

As always feel free to leave a comment down below for any question you have about this article and I’ll be answering! Remember, we are all here to learn and there are no stupid questions.

Thank you !